| profmax us |

by J. Doug Ohmans

© 2005

Supply is average cost, not marginal cost. SinceCHAP 1 - MARGINAL MAN

demand is average revenue, supply and demand can

be taught before marginalism. Since 1871 marginal

cost MC pricing has engendered inequality.

|

McConnell & Brue, Economics

Bade & Parkin, Foundations of Microeconomics

"D = MB and S = MC is the symmetry

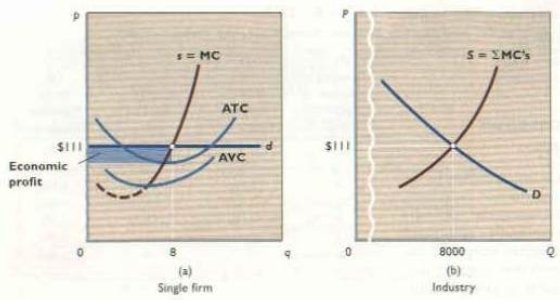

For Perfect comp, P = AR = MR = MC = AC = S in LRE but not in SRE

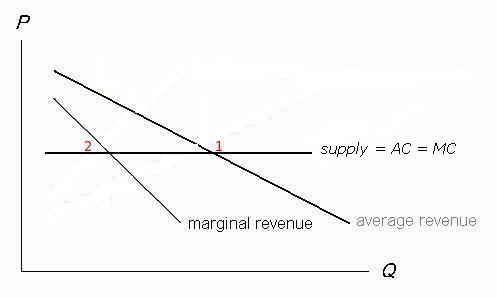

For Monop (single price) P = AR > MR = MC > AC.

There is no symmetry with D = P = AR = S in all markets and circumstances."

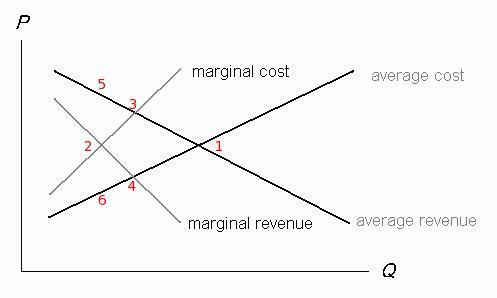

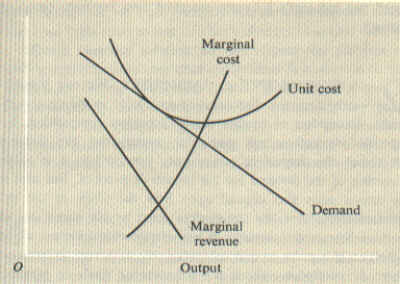

(Private email from economist Michael Parkin, 4/12/2010). But demand as marginal benefit is AR, whereas his supply is MC, not AC. Symmetry is lost between consumption and production in an MC=AR "equilibrium." The standard diagrams are wrong or worse. Perfect competitors operate where AC=AR and MC=MR, monopolists where MC=MR and AR exceeds P. For their part, oligopolists (not to mention monopolistic competitors) might operate where MC=AR. According to one economist, variable costs VC are often substituted for MC:

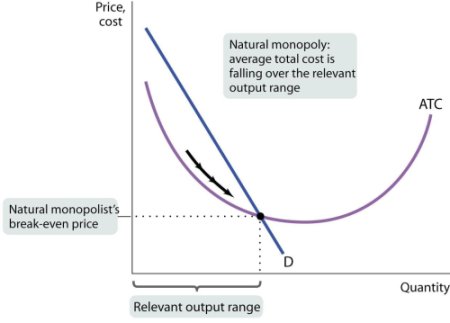

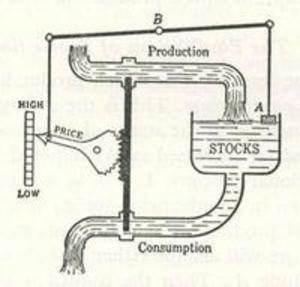

"In a product market, the supply curve (in orthodox econ, and it's not that different in Marxian econ. in the short run) is defined as nothing but the set of points corresponding to the amount that firms in an industry will supply at each price. Given a price, each firm decides how much to bring to the market. At that price, the industry supply is the sum of all the firm supply decisions. For a monopoly, price isn't _given_ by the market. Rather, it manipulates the amount on the market to determine this price (in order to maximize profits).In Alienation and the Soviet Economy Paul Craig Roberts says, "A hierarchy accomplishes its task by the coordination of the activities of those at the base of the pyramid... It follows that there is a definite limit to the number of tasks a hierarchy can achieve yearly" (New York, Holmes & Meier, 1990,c1971, pp.65-66). If hierarchy cannot abolish exchange value and commodity production, "in competitive theory the equating of marginal cost to price is the result of wealth-maximizing behavior; no one has as his conscious purpose to make marginal cost equal to price" (Ibid. p.96). Yet perhaps some might set their price equal to average variable cost. Ultimately, the average versus marginal supply curve conundrum can be resolved as follows. In Economics of Socialism (Books for Libraries, Freeport NY, 1971) Henry Dickinson wrote in 1939, "If goods are valued according to the cost of the marginal portion of supply...a surplus would emerge which could be treated as rent. If, however, goods were valued according to their average cost of production...then rent will be absorbed into cost. The question whether or not rent should be reckoned as a separate entity is thus seen to be identical with the problem whether goods should be valued according to marginal or average cost of production" (p.77). The micro debate around the nature of the supply curve, whether it should be average or be marginal costs, moves from economic truth to politics when socialism opts against purely short-term profit maximization at MC=MR and TR>TC in situations of decreasing costs. Dickinson (Ibid. p.108) recommends to socialists the use of a "Marginal Cost Equalization Fund, into which would be paid all positive rents arising from increasing-cost goods and out of which would be paid subsidies to maintain the production of diminishing-cost goods," which might reimburse producers of necessities for their expansion. The state of introductory microeconomics at the dawn of the Third Millennium is troubled. Traditional theory places the "perfect competition" intersection or equilibrium at that point where MC=AR. That is a deformation required to rationalize the capitalist mentality, yet not the only arguable point of view. The Polish socialist economist Oscar Lange wrote, "For the economy to be capitalist, according to our definition, money profit must be the sole objective of the units engaged in production. This excludes an economy in which the satisfaction of wants competes with the profit-making objective. A craftsman may refuse an opportunity of making an additional money profit because it is not worth the effort involved or because he prefers to devote his time to the satisfaction of specific wants, such as company, entertainment, etc. A farmer may fail to maximize money profit because he prefers to consume some of his products instead of selling them" (Oscar Lange, "The Scope and Method of Economics" in Neel, Readings in Price Theory, 1973, p.14). In a nutshell, profit maximization occurs where MC=MR. But that point, though good for an individual, embodies inequality and therefore should be resisted (see An Intelligent Woman's Guide to Socialism by George Bernard Shaw, 1928). On the other hand, efficiency has its place. Nevertheless, the claims of everything average are worth exploring. The AC=AR utopia needs illumination to withstand the assault of widespread marginalist rationality. What good would be an economic theory which does not revolve around the point of actual (profit) maximizing behavior. It would be considered "normative" to hold out for an AC=AR equilibrium yet such a utopia unquestionably exists in concept. Yet suppliers' behavior may or may not oblige this preference. Probably price theorists sympathetic to capitalism--perhaps resource economists opposing "waste" and "inefficiency"--would not allow the non-monopolist (or the monopolist either) to incur a loss on marginal transactions. Yet in existence survival itself enforces the AC=AR identity. All microeconomics teachers must begin with a belabored distinction between X as citizen and X as economist. By applying the Grid X paradigm, the economist can swallow up the citizen, maintain exact thought and not forgo value judgments. Fair pricing (AC=AR) is easy to teach, because supply and demand can be introduced before marginalism. It could be ideological capitalist apologetics to call the marginalist equilibrium MC=AR the socially optimal price. Who is to say that "supply" must be marginal costs. That is not science. The library shelves are full of written works: it is simply a matter of mixing the epoxy compound of content with the liquid hardener of structure until the argument emerges. CHAP 2 - VIRTUAL SUPPLY Teachers of microeconomics, the supply curve is a vexed affair, but the so-called "demand curve" is easily understood, and should be our starting point. "Demand has two major parameters, magnitude and elasticity" (Kenneth Boulding, Economic Analysis, vol.1: microeconomics, 1966, p.538). While demand and diminishing returns are self-evident in the phenomenon of hunger, the "law of supply" is considerably more vexed. All we know of it to begin with is a set of "equilibrium" points on various demand curves: at such and such a price, a transaction occurred. In Understanding Microeconomics (Englewood Cliffs NJ, Prentice-Hall, 1984) Robert Heilbroner and Lester Thurow argue: "The point we must bear in mind is more than just a geometrical demonstration. It is that marginal costs, not average cost, determine most production decisions. When prices rise or fall, the change in quantity will reflect the ease or difficulty of adding to or diminishing production, as that ease or difficulty is reflected in the shape of its MC schedule" (p.166). Yet they say "We use average costs and average revenues to calculate profits" (p.169). At the same time, "We use marginal costs and marginal revenues to determine the point of optimum output" (Ibid). The two approaches co-exist uneasily. Technically "the pure monopolist has no supply curve. There is no unique relationship between price and quantity supplied for a monopolist. Like the competitive firm, the monopolist equates marginal revenue and marginal cost to determine output, but for the monopolist marginal revenue is less than price. Because the monopolist does not equate marginal cost to price, it is possible for different demand conditions to bring about different prices for the same output" (McConnell & Brue, Economics: principles, problems, and policies, 2005, p.446). As early as 1914, P. H. Wicksteed wrote of the supply curve, "I say it boldly and baldly there is no such thing.... What is usually called the supply curve is in reality the demand curve of those who possess the commodity" (quoted in T. H. Hutchison, Review of Economic Doctrines, 1870-1929, 1953, p.102). An average cost supply curve is not unheard of. 70 years ago, "an interesting deviation from the marginalist position was E. F. M. Durbin's argument for socialist economic planning based on the average cost concept. While he conceded that equalizing the marginal product in all possible uses might be desirable, he felt that price determination under socialism would at best be but roughly solved in this manner. Durbin questioned whether it would be possible to increase output until price was equal to marginal cost. In fact, where industries in a socialist society operated under conditions of increasing returns, the marginal cost pricing rule could not provide a suitable guide, since average cost would exceed marginal cost over a considerable output range. This could lead to a loss in income which would have to be covered by public subsidy. The best policy would be to abandon marginal cost as the pricing rule and turn to average cost" (Ben Seligman, Main Currents in Modern Economics, 1962, p.117). Seligman shows how Durbin argued, "there was no clear distinction between maintenance cost and marginal prime cost. Additionally, a socialist pricing mechanism based on average cost could simplify matters considerably, for it would allow plant managers to react independently to changes in market conditions and would avoid the complex system of subsidies and taxes required by the marginalist approach. Obviously, Durbin's solution was a matter of practicality, for while he conceded that the correct theoretical answer had been given by the marginalists, he felt that accounting along such lines would fail to show the proper responsibility since profits and losses would be determined by factors beyond a plant manager's control. Moreover, what really had to be taken into account was the anticipated future average cost. The relevant cost curves, both average and marginal, would have to be based on estimates of future costs, said Durbin. If the process of production was continuous, as it necessarily was in an advanced economy, all replacement costs would have to be met and accounted for in current costing procedures. But marginalist methods overlooked this element, argued Durbin, since the pricing technique that stemmed from its logic covered only the cost of hiring input factors which had alternative uses in the present. And this could lead to considerable price variation, an undesirable consequence. The fact was that all future payments were to be included in price estimates - long period, short period, fixed, variable and replacement, as well as current. This implied that output would have to be varied to cover average costs" (Ibid). Paul J. McNulty argues that "the single activity which best characterized the meaning of competition in classical economics--price cutting by an individual firm in order to get rid of excess supplies--becomes the one activity impossible under perfect competition" (McNulty, "Economic Theory and the Meaning of Competition" Q.J.E. v.82 no.4 Nov. 1968, in Neel, op.cit, p.303). The pure competitor can adjust only her quantity, not the price. "The conception," says McNulty, "has taken two basic, and fundamentally different, forms. On the one hand, it has been the 'force' which, by equating prices and marginal costs, assures allocative efficiency in the use of resources. Competition in this sense is somewhat analogous to the force of gravitation in physical science; through competition, resources 'gravitate' toward their most productive uses, and, through competition, price is 'forced' to the lowest level which is sustainable over the long run. Thus viewed, competition assures order and stability in the economic world much as does gravitation in the physical world. But competition has also been conceived of in a second way, as a descriptive term characterizing a particular (idealized) situation" (Ibid. p.297). Money unifies price and cost only under perfect competition: otherwise, excess profit separates price from value. Profitability and not some other values may determine what is the economically rational output, but a lack of symmetry is introduced that can make micro seem as dismal as applied economics, or macroeconomics. Mathematical economists (1950-2000) tell us that the slope is the first derivative of the total curve's equation. We, on the other hand, must take refuge in geometrical thinking:

"For a purely competitive market, in theory, the decision is made by setting marginal cost equal to the price (expanding output as long as the marginal benefit--equal to price--is greater than marginal cost and shrinking output if marginal benefit is less than marginal cost).

"That's it. But in most markets, especially in manufacturing, the best way that an economist or a firm can figure out the value of marginal cost is to look at average variable cost (average cost net of overhead). That's because marginal cost is often hard to calculate. It usually turns out that price is greater than measured marginal cost, however, suggesting that most firms have monopoly power" (Private email from economist Jim Devine, 6/8/2005).

"According to Kaleckian Keynesian economics, the supply curve in manufacturing, services, retail, etc. is the AC curve, usually determined by marking up the AVC. In the primary-product sector, on the other hand, MC is it" (Ibid. 4/1/2009).

The history of economic thought provides many clues to the true nature of the supply curve. Drawing on Ben Seligman's ground-breaking tome, Main Currents in Modern Economics, it may be seen that there is more to microeconomics, economics teachers, than Jevons. According to John R. Hicks, "cost, revenue, and productivity in their marginal form are said to simplify economic thinking. Decision-making can be founded on marginal concepts even though total or average figures are not known" (Seligman, Ibid., p.102). Thus people asserting self-interest compute using marginals even though they may not know what sort of concept they are using. Republicans, so to speak, think maximizing profit trumps morality. They may even develop a bad conscience about acting unselfishly. Lange wrote, "Firms or business enterprises have as their objective one single magnitude, namely, money profit. In this they differ from households and public services. A household, for instance, desires to satisfy several wants, not to pursue merely one magnitude as an objective" (Lange, op.cit., p.13). If efficiency is that magnitude, as under Taylorism, "decisions on output and investment were to be made by plant managers on the assumption that resources would be utilized up to the point where marginal cost equaled price, that is, to the point at which the cost of producing an additional unit would just be covered by the prevailing unit return. The premise was that marginal cost would increase with further output, a seemingly reasonable surmise. Consequently, production beyond the equality of marginal cost to price would merely incur losses. This was, of course, the short-run view: in the long run, new investment would be undertaken if the return from the added output would be equal to or greater than the long period cost incurred" (Seligman, op.cit., p.109). Maurice Clark brought some of Durbin's point of view into the mainstream: "The cost curves theorists talked about were intended to isolate the effects of shifts in output. But Clark found that the short run cost curve usually represented operations at varying percentages of capacity, so that it was necessary to imagine a zone of cost rather than a line. Operations at a stated level of output were bound to differ with the length of time a plant remained at a given capacity rate. That is, changes to new output levels involved costs that had not been explained in theory. One also had to consider capital attrition, particularly when prices changed as capital replacements became due. Further, the utilization of 'standard' cost formulas raised the question of full cost pricing, under which prices were set to cover all costs. This, in effect, meant employing average rather than marginal cost as the major consideration, an approach which seemed quite characteristic of the business man's mode of thinking" (Ibid. pp.215-6). Underconsumptionist John A. Hobson (1858-1940) who inspired Lenin's Imperialism, also found a need for an average cost supply curve: "In defining the nature of productivity, Hobson argued that no separation could be made between cooperating factors; all were essential to produce goods and no specific productivity could be attributed to any single factor. He rejected, consequently, the theory of marginal productivity. What seemed more important to him was the average productivity of the group input factor" (Ibid. p.232). In Hobson's words, "Adding doses of labour and noting the increase in the aggregate product throws no serviceable light upon the determination of wages. The so-called marginal dose with its separate product, is only intelligible when regarded as an average dose in a fully equipped farm, factory, shop or other business: no separate dose has any separate product, and the only method of assigning it to any product is to divide the whole product equally among the constituent units, as if it represented the mere addition of their industrial productivity instead of their joint co-operative productivity" (John A. Hobson, The Industrial System, 1910, p.115). "The more important concept was average productivity which varied with the efficiency of the group and should be imputed in equal proportions among the members. As applied to labor, such a division supplied the upper limit of payments, just as alternative work opportunities supplied the lower limit. "Hobson went further, attacking the preconception of marginal utility itself with its proposition of fluidity in capital and labor, full knowledge of the market, and the like. In a society of imperfect competition, marginalism provided a false theory, said he (Hobson, op.cit. p.152). Insofar as price was concerned, changes were due to alterations in the average expense of the entire complex of factors. It was average costs that determined supply prices. "Hobson continued his attack on marginalist notions in his Free Thought in the Social Sciences (p.112). The 'dosing' method, he argued here, implied that there was no profit at the margin of capital and that therefore profit did not affect price. Such an error, said Hobson, could stem only from the improper treatment of one factor as fixed and the others as variable, thus revealing an erroneous application of the law of diminishing returns" (Seligman, op.cit. p.233). Economist Robert Gordon would add that the practical businessperson isn't necessarily a capitalist profiteer. "General experience," he says, "has indicated that businessmen will seek maximum sales, not profits, as the primary goal. Naturally, profit considerations are taken into account, but there is great reluctance to cut back on revenue. The pricing technique generally employed is a reasonable or customary markup on full average cost... "But quite simply, it is perfectly possible that maximum profit may not be the final aim; as Robert A. Gordon says, 'satisfactory' profits may be deemed sufficient. If this be so, then the average concept rather than the marginal one may be appropriate.... Moreover, marginal computations in a multi-process plant are difficult, if not impossible, so that price determination on the basis of average total cost for some normal or usual output may be a more useful procedure" (Ibid. p.364). For Leon Walras (1834-1910) "marginal utility was of course a mathematical concept. In fact, Walras may be considered as one of the discoverers of this central idea. Labeled by him as rareté, it was a decreasing function of the quantity consumed, and was proportional to the price paid. Marginal utility was attained when the last units of expenditure in the consumer's scale of preferences (given the available income) yielded equivalent satisfactions to the point of equilibrium. Utility was maximized when these conditions prevailed. Mathematically, it was measured by the derivative of total utility, thus tying together not only the quantity of a good and its utility but also indicating the rate of change in utility for each unit of the good" (Ibid. p.374). When Paul Samuelson wrote Economics in 1948, his "neoclassical synthesis" updated Alfred Marshall's classical synthesis from 1890, Principles of Economics. Marshall had seen that "in the long run, price tended to gyrate about cost as the forces of supply and demand played out their skein. In the short run, prices would not fall below prime costs; in the long run, both prime and overhead, or supplementary, costs would have to be covered" (Ibid. p.469). Seligman asks, "What then happened to supply in the long run. Some commentators have felt that the latter simply disappeared and the long run became nothing more than a series of little short runs. If this is a valid criticism, it may very well be charged that the entire Marshallian time analysis has fallen to the ground" (Ibid. p.470). One difference between the long and the short runs is that elasticity is less in the short run. A. Marshall not only synthesized the labor and utility value theories, he synthesized the theoretical and practical/ business points of view. "Through his graphical analysis he was able to show how a monopolist could limit supply and so set the price of a good. But he wondered whether some monopolists might not consider an increase in consumers' surplus just as desirable as a monopoly profit (Alfred Marshall, Principles of Economics, p.487). This implied that instances might occur when it would pay for monopolies to sell at prices lower than their market position could permit them to dictate. It thus might be reasonable for a railroad to build up a community with a view toward future business. This was not a matter of altruism; it was merely foresight. Furthermore, greediness might generate public hostility and legal action" (Seligman, op.cit. pp.474-5). Arthur Cecil Pigou was from that era but lived until 1959. His welfare economics included the view that "under competitive conditions, supply price equalled both marginal and average cost in the long run.... Industries with decreasing supply price were more apt to wind up in monopoly, since marginal cost could be less than average cost over a fairly wide range of output, thus strengthening Pigou's argument for limited intervention.... In this model, an ever expanding economic universe was not possible because the supply of land was limited, enforcing diminishing returns. The latter eventually affected all other factors as well so equilibrium finally was reached" (Ibid. pp.484-6). Sir Dennis Robertson, however, suggests how diminishing returns can be averted for a long time. "Increased gains, Robertson suggested, did not always stem from external economies: many could be traced to internal elements, so that increased output over time might be explained more simply by decreased cost per unit" (Ibid. p.499). NYU professor emeritus William Baumol wrote, "It does seem, after all, that the businessman's primary concern is 'sales maximization subject to a minimum profit constraint' (W. J. Baumol, Business Behavior, Value and Growth, 1959, p.49). Output which maximizes sales is determined at the point where marginal revenue is zero, Baumol has said. A profit maximizing output, therefore, is necessarily less than a sales maximizing output" (Seligman, op.cit. p.514). Sales are linked to AC=AR. Writing at the end of the 19th century, the Swede Knut Wicksell put utility theory on a subjective yet mathematical basis. "While scarcity was conceded to be a significant element, it was marginal utility that was deemed crucial. No longer was there need to feel that what one party gained in an exchange, the other lost: both were winners. Wicksell did admit some relationship between value and cost, but this was essentially peripheral. Utility was defined in its strictest sense as a mathematical function of the quantity of a good, with marginal utility as the first derivative of total utility. Marginal utility, therefore, was a measure of the rate of change in total utility" (Ibid. p.544). Frank H. Knight (1885-1972) contributed an analysis of long-term supply which came down to more objective factors than subjective demand. "Even for the long run, Knight rejected the idea of supply as a function of price, for with constant costs price could easily adjust to shifts in demand. With decreasing cost, monopoly would tend to rear its head and again output would be independent of price. Nor was supply the obverse of demand, as in the theory of reservation prices, since production was undertaken for sale; and even when the goods could not be stored or moved to another market, producers were in no position to consume their own output. The supply curvewas essentially a cost of production curve, showing costas a function of output. Such a long period analysis,said Knight, would suggest to producers that with decreasing costs less output would be forthcoming at higher prices than at lower ones. This paradox proved to Knight that decreasing cost as a long-run tendency was impossible under competitive conditions, for, given the latter, costs would be quickly adjusted for all producers" (Ibid. p.653). The author knew Kenneth Boulding, the long- and grey-haired stuttering genius from Boulder. He was prolific and unerring. Here he points out that theory and practice are different things: "The information system [of the firm] reveals average costs, it reveals sales, production, inventory, debt and other figures in the balance sheet and income statements. It does not, however, generally reveal marginal costs and still less does it reveal marginal revenues. If the firm cannot know when it is not maximizing profits, therefore, there is no reason to suppose that it maximizes them" (Boulding, 'Implications for General Economics of More Realistic Theories of the Firm,' AEA Proceedings, May 1952, p.36). Seligman admits "The 'Reconstruction of Economics' containing Boulding's major technical contributions, unfortunately has not received the attention it merits" (Seligman, op.cit. p.684-7). Boulding wanted economists to look at wealth, a stock, and not only income, a flow. Grix X is a "reconstruction" in that it refuses to find equilibrium at P=AR=MC. Now when Piero Sraffa had completed his ten-volume edition of Ricardo, he could credibly argue that "an industry could not be in equilibrium if external economies governed its flow of output.... The only way to solve the problem, said Sraffa, was to drop the assumption of free competition and to move in the direction of an analysis of monopoly.... It blew the older theory virtually to bits" (Ibid. p.714-5). Writing in Germany in the 1930's, Heinrich von Stackelberg made several advances towards developing a supply curve. Stackelberg saw that "in pure competition, equilibrium was established by the intersection of the supply and demand curves, with lags explained by cobweb movements around the point of equilibrium.... And the divergence of marginal revenue from average revenue could be measured by dividing price by the elasticity of demand, a relationship that described monopoly price" (Ibid. p.726). Keynes belongs to British macroeconomics, from the era of Joan Robinson and the American Edward Chamberlain's theories of oligopoly. For Keynes, "total employment is created by expected total proceeds from forthcoming production. This was aggregate demand. The cost of producing total output was called aggregate supply. Now, it should be clear that if production is to occur, total expected proceeds must cover costs" (Ibid. p.738). Marshall's diagrams were in plane geometry. By the 20th century, more sophisticated "grids" could be modeled Neumann's and Morgenstern's game theory, for instance, explored how "when both strategies coincided, that is, when both the maximin and the minimax were found in the same cell or element of the matrix, a 'saddle point' or equilibrium had been achieved.... This was the sort of game that began to approach the character of an economic situation, as in labor relations or oligopoly.... Game theory has not been completely successful. But at least the point has been emphasized, one that has not always been obvious to economists, that maximization is not necessarily the essence of economic existence. Lacking control of all the variables that affect a payoff, players may be satisfied with more modest results" (Ibid. pp.776-7). "Thus recent theory," says Seligman (1962) "has supplied us with minimax man, simulating man, potential surprise man, sequential decision-making man, satisficing man, and heroic man, as well as attempting from time to time to resuscitate self-centered, greedy economic man. Minimax man, whom we have already met, is a worrier, not overly aggressive, preferring the safe and sane way, very much like executives in the middling reaches of the corporate milieu. Simulating man, completely undecided as to what to do, feeds information into a digital computer to help make up his mind. The sequential decision-maker, equally uncertain, equally cautious, addresses himself to the unknown contingencies of nature and society with a slide rule in order to see whether he can continue the even tenor of his ways before making good on some collosal error. Potential-surprise man is willing to gamble on a single throw of the dice in the hope of making a fat killing. Satisficing man isn't interested in optimal behavior at all. Something of a second cousin to minimax man, he is content merely with satisfactory results. Most challenging of all is Boulding's heroic man whose ethic is an expression of those noneconomic drives that give meaning to existence" (Ibid. pp.785-6). "Indeed," says Seligman, "the whole theory of the competitive economy, curious model that it is, has been turned into little more than a value judgment" (Ibid. p.788). Our Grid X paradigm, on the other hand, is formally undeniable and encompasses both competition and monopoly. "Whatever the method employed--verbal, mathematical, statistical, historical, econometric--the crucial matter is the choice of the problem" (Ibid. p.790). Grid X is true insofar as it assumes: a) only price and quantity, b) only price and quantity of cost and revenue, and c) only price and quantity of cost and revenue between their average and marginal extremes (which becomes a normative scale). CHAP 4 - PROFIT DEFLATION A myth entered earlier with the assumption that one must maximize profit. The linguist George Lakoff writes, "There is a myth that comes down from the Enlightenment, and it goes like this. It is irrational to go against your self-interest, and therefore a normal person, who is rational, reasons on the basis of self-interest. Modern economic theory and foreign policy are set up on the basis of that assumption. The myth has been challenged by cognitive scientists such as Daniel Kahneman (who won the Nobel Prize in economics for his theory) and Amos Tversky, who have shown that people do not really think that way. Nevertheless, most of economics is still based on the assumption that people will naturally always think in terms of their self-interest" (Don't Think of an Elephant, 2004, p.18). The marginalists' insight--the exact determination of individual self-interest--may have had a corrosive effect upon organic solidarity. Yet the Enlightenment mentality cannot seem to resist the social efficiency argument, that it would be wasteful to produce at a loss. Purchasers situated between the average cost price and the marginal cost price are those who lose out. To complete "Grid X" to the limits of its explanatory power, one would have to deal systematically with permutations of eight additional situations, four for supply and four for demand: these are designated "backward-rising", "forward-falling" and "forward-rising", "backward-falling" (Nicholas Kaldor, Essays,1960, p.26). Backward-rising supply, I imagine, is what economists call backward "bending" supply of e.g. labor. To reduce both costs and revenues to money is valid at the point where price and quantity on both curves converge, while just a phantasm at other points. For that is where the deal was struck. From any point, an X-like grid can be posited and identified. The intersection may be where AC=AR or where MC=MR or where MC=AR or (unlikely) where AC=MR.